In today’s financial world, credit plays a pivotal role in personal finance management, influencing nearly every major financial decision a person makes. From purchasing a home or car to starting a business or simply building wealth, understanding and managing credit is key to achieving financial stability and long-term success. This article delves into the significance of credit in personal finance, how it affects various aspects of financial life, and the strategies for effective credit management.

What Is Credit?

Credit refers to the ability to borrow money or access goods or services with the promise to repay at a later date. It comes in various forms, including credit cards, mortgages, personal loans, and lines of credit. Financial institutions extend credit based on an individual’s perceived ability to repay, which is primarily determined by their credit history and score.

Key Takeaways

- Credit Influences Borrowing Costs: High credit scores lead to better interest rates and terms.

- Credit Scores Reflect Financial Trustworthiness: Lenders rely on scores to assess risk.

- Effective Credit Management Is Crucial: Paying bills on time, monitoring utilization, and diversifying credit can improve your score.

- Impact on Career and Life Opportunities: Credit can influence employment, housing, and other life aspects.

- Regular Monitoring and Responsible Behavior Pay Off: Staying on top of your credit is key to maintaining financial health.

The Role of Credit in Personal Finance Management

- Building a Credit History

A solid credit history opens the door to favorable borrowing terms and interest rates. When you use credit responsibly over time, it demonstrates to lenders that you are trustworthy, making it easier to qualify for loans and other credit-based products.

Impact on Personal Finance:- Higher credit limits and lower interest rates on loans.

- Easier approval for rental applications and utilities.

- Access to Loans and Mortgages

Credit scores directly impact your ability to obtain loans for major purchases such as homes and cars. Lenders assess creditworthiness to determine the terms of a loan, including the interest rate and loan amount.

Impact on Personal Finance:- Better credit scores can save thousands of dollars in interest over time.

- Individuals with poor credit may face higher costs or outright rejection for loans.

- Credit Cards as a Financial Tool

Credit cards, when used responsibly, offer convenience, security, and rewards. They also provide an opportunity to build or rebuild credit. However, misuse can lead to debt accumulation and financial strain.

Impact on Personal Finance:- Helps establish a strong credit history through on-time payments.

- Provides cash flow flexibility and emergency funding options.

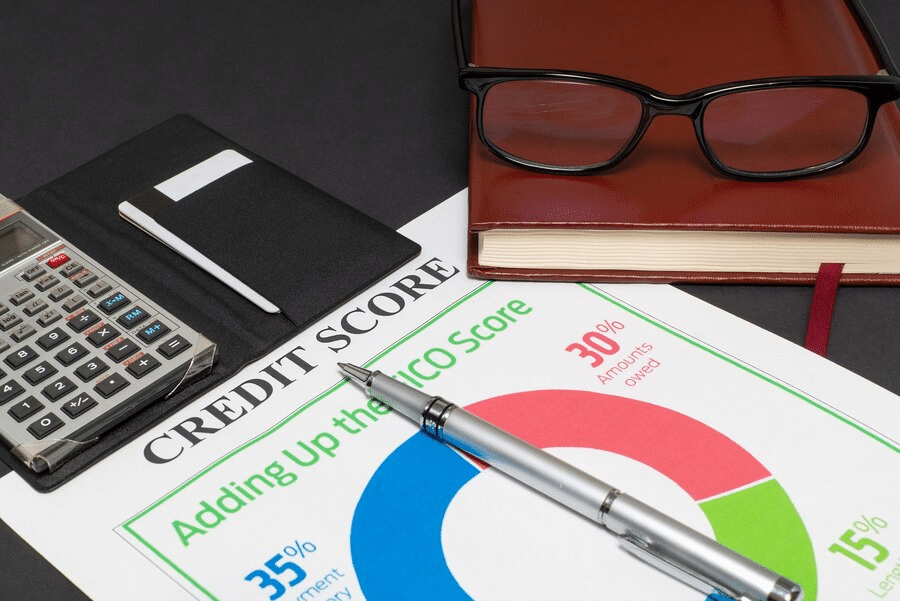

- The Importance of Credit Scores

Credit scores are a numerical representation of your creditworthiness, with factors such as payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries contributing to the score.

Impact on Personal Finance:- High credit scores increase access to credit and reduce borrowing costs.

- Low scores may result in higher interest rates and limited financial options.

- Impact on Interest Rates and Borrowing Costs

The interest rate you pay on loans is heavily influenced by your credit score. Lower scores typically lead to higher interest rates, increasing the total cost of borrowing. Conversely, a high credit score can secure favorable terms.

Impact on Personal Finance:- Credit score improvements can lead to significant savings over the life of a loan.

- Poor credit can lead to “subprime” loan products with higher costs.

- Credit and Financial Planning

Managing credit effectively is integral to financial planning. Responsible credit management supports wealth accumulation, financial security, and goal achievement, whether buying a home, saving for retirement, or starting a business.

Impact on Personal Finance:- Balancing credit utilization with savings and investments can enhance long-term financial well-being.

- Poor credit management can derail financial goals due to mounting debt and financial stress.

- Credit and Employment Background Checks

Some employers perform credit checks as part of the hiring process, particularly for roles involving financial responsibilities. While not universal, poor credit history can impact employment opportunities in specific sectors.

Impact on Personal Finance:- Positive credit reports can enhance job prospects.

- Negative credit reports may hinder career advancement.

Strategies for Effective Credit Management

- Monitor Your Credit Report Regularly

Regularly reviewing your credit report helps identify errors, track progress, and spot signs of identity theft.

Tip: Obtain free annual credit reports from reputable sources like AnnualCreditReport.com. - Pay Bills on Time

Payment history is a significant factor in credit scoring. Consistently paying bills on time can improve or maintain your credit score.

Tip: Set up automatic payments or reminders to avoid late payments. - Maintain a Low Credit Utilization Ratio

Aim to keep your credit utilization below 30%. High balances relative to credit limits can negatively impact your score.

Tip: Pay down balances monthly to reduce utilization. - Limit Hard Inquiries

Each hard inquiry (e.g., applying for new credit) can slightly lower your score. Limit new credit applications to essential needs.

Tip: Shop around for loans within a short period to minimize multiple inquiries. - Diversify Your Credit Mix

Having a mix of credit accounts (e.g., credit cards, loans) can positively influence your score if managed responsibly.

Tip: Avoid opening accounts you don’t need solely to diversify.

Also Read : What Is Financial Literacy And Why Is It Important For Managing Personal Finances?

Conclusion

Credit plays an essential role in personal finance management, influencing your ability to borrow, save, and achieve financial goals. By understanding how credit works, maintaining a strong credit score, and managing debt responsibly, individuals can open doors to financial opportunities and enjoy better terms on loans and other credit products. Effective credit management is not just about improving a score—it’s about achieving financial security and building a prosperous future.

FAQs

What Is a Good Credit Score?

A good credit score generally falls between 670 and 739. Scores above 740 are considered excellent, while scores below 580 are poor.

How Can I Improve My Credit Score Quickly?

Pay down credit card balances, make on-time payments, and dispute inaccuracies on your credit report to boost your score quickly.

Does Carrying a Balance on My Credit Card Improve My Credit Score?

No, carrying a balance does not boost your score. It can lead to unnecessary interest charges. Paying off the balance monthly is better.

What Factors Affect My Credit Score the Most?

Payment history, credit utilization, length of credit history, types of credit used, and recent inquiries are key factors.

Can I Get a Loan with Bad Credit?

Yes, but it may come with higher interest rates and less favorable terms. Improving your credit score can lead to better offers.

How Often Should I Check My Credit Report?

You should check your credit report at least once a year or more frequently if you’re managing credit issues.

Do All Lenders Use the Same Credit Scoring Models?

No, different lenders may use different scoring models, such as FICO or VantageScore, which can produce slight variations.